We looked at some of our own SMS traffic data. Here's what we see.

It is a well-known fact that the increasing use of data-based messaging applications such as WhatsApp and Viber as well as the growing use of the mobile internet has resulted in less SMS activity compared to only a few years ago.

However, Tele2 pointed out a lesser-known trend: the rise of A2P (application-to-person) SMS messages. These are not messages being sent from one phone to another, but from a software application directly to a person's mobile phone (i.e., a company sending SMS messages through Messente’s platform).

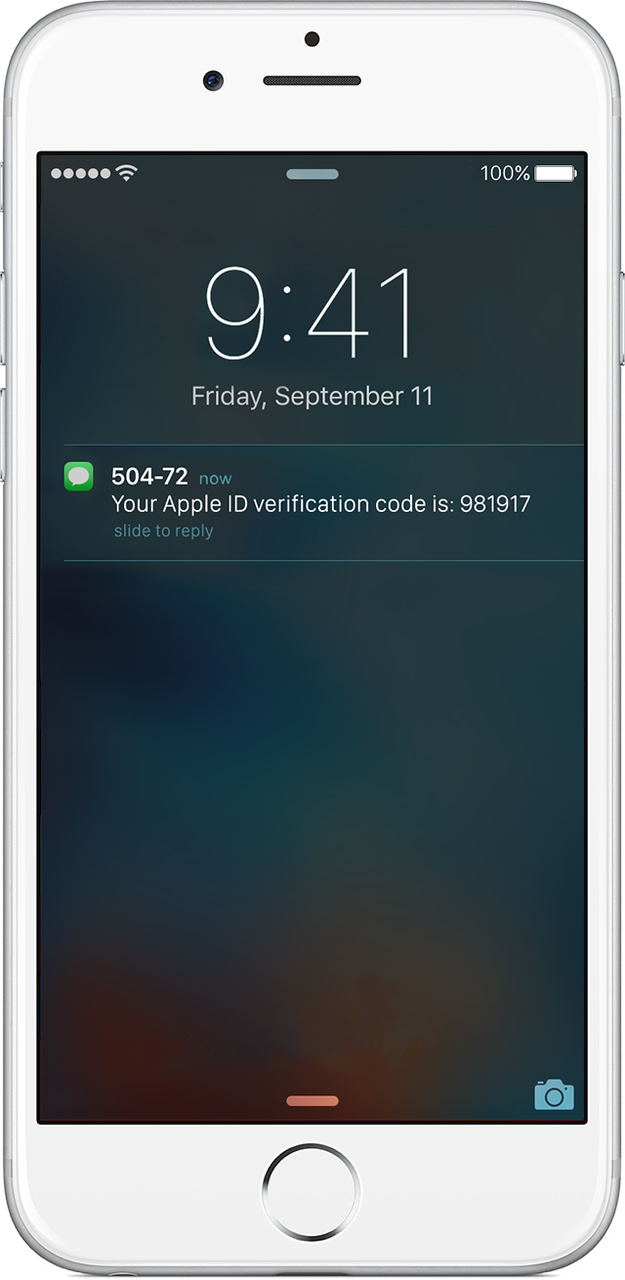

Login PIN codes from online services, courier delivery notifications, doctor's appointment reminders, and bank notifications, are all examples of A2P messages. Every industry uses SMS messages in a different way.

Tele2 explained that while A2P messages were only 4% of their total messaging traffic a few years back, these messages now make up 13-17% it. Delivering customers’ SMS messages to over 500 networks in the world, we see the same trend occurring globally. The use of A2P messages is growing especially fast in industries like financial services, logistics, last-mile delivery, web security, and health services.

Based on our data, we see A2P SMS traffic growing much faster in Latin America and South-East Asia than it is in Europe. One of the drivers for this is the expansion of European companies to those markets. If we look at the investment and expansion trends of many European fintech companies, a very clear trend emerges - growth in LatAm and SEA. Stable income in the EU.

But why does that mean an increase in SMS usage? Simple - it still has the largest coverage, still boasts a super high open and read rate as well as gets the message there quickly. So, it’s the go-to tool for immediate communication, client verification, One Time Passwords and marketing to build relationships with the customers. The more emerging the market, the less likely they are to have a strong data infrastructure in place to support data-based messaging apps. Thus, SMS is still the way to go.

A2P messaging is a huge business

Analysts claim that A2P messaging will be a 70-billion-dollar business by the year 2020. The biggest source of growth will not be from marketing, as one might think. It will rather be from customer relationship management, from onboarding to short notifications and account security throughout the entire lifetime of a customer.

SMS messaging is still the most universal way to reach out to someone. This is the main reason for the ongoing popularity in SMS, despite other communication channels emerging and disappearing in the same space. It works regardless of location, the model of the phone, whether online or offline and doesn't require a specific app to be installed.

In the future, there may be universal standards and technology that could be replacing SMS messaging almost completely. In any case, if you’re wondering, no, I don’t mean Facebook Messenger or WhatsApp.

However, this will be a blog post for some other time.

Right now, we have no choice but to completely agree with Tele2. A2P SMS messaging traffic is growing. And it’s doing so everywhere in the world.